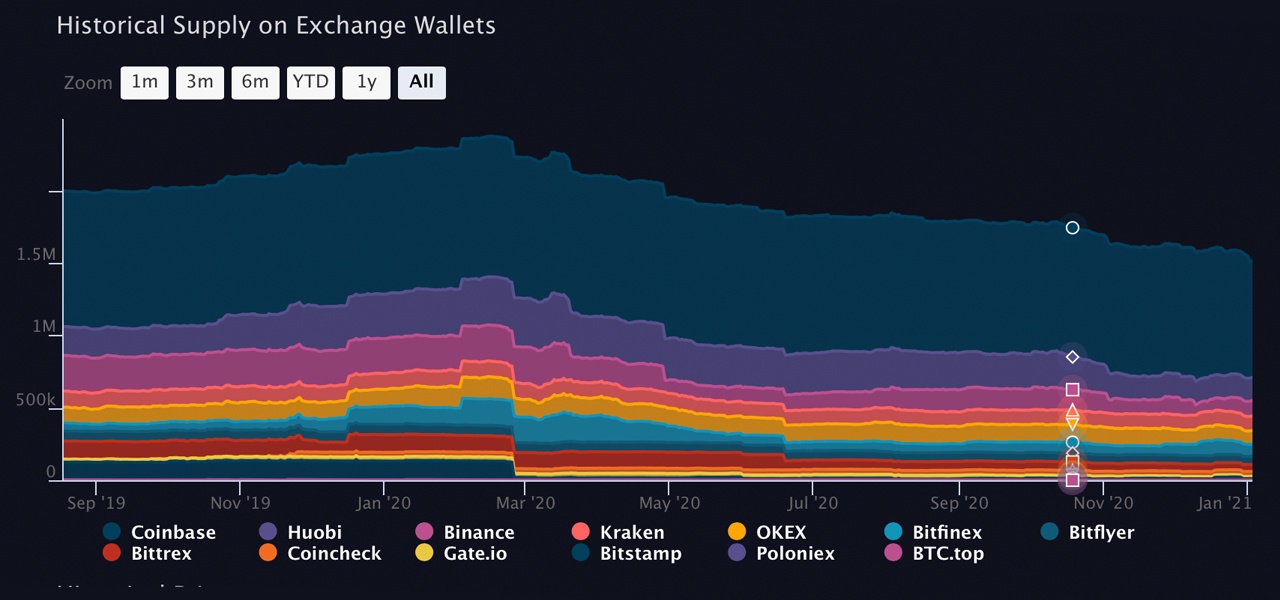

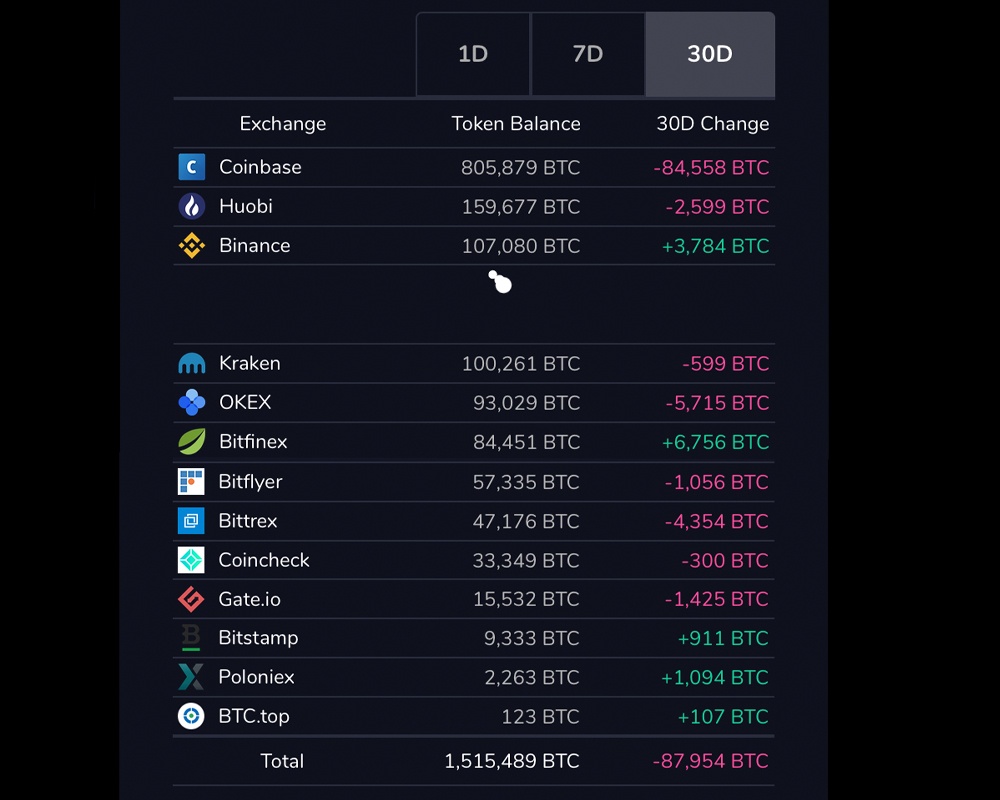

Despite the bitcoin price high, there continues to be a massive exodus of bitcoin leaving exchanges. Onchain data shows exchanges are being drained like a sieve and during the last 30 days, 87,954 bitcoin was withdrawn from the top crypto trading platforms.

Back in December 2019, it was reported that the San Francisco-based exchange Coinbase held close to 1 million BTC for its users. In fact, in January 2020, Coinbase had around 969,000 BTC and the next month, it was up to its highest point of 973,000 BTC on February 10, 2020.

But all year long, not only from Coinbase, but also a slew of other popular exchanges have seen massive amounts of bitcoin withdrawn. After holding close to a million BTC on February 10, 2020, today the exchange only holds 805,000 BTC.

The top five exchanges, in terms of bitcoin reserves held, have lost a substantial amount of BTC from customer withdrawals. This includes exchanges like Huobi, Binance, Kraken, Okex, Bitfinex, and Bitflyer. During the last 30 days, Coinbase has seen a whopping 84,558 BTC withdrawn, Okex has seen 5,715 BTC withdrawn and Huobi has seen 2,599 BTC leave the exchange.

The largest exchanges, in terms of BTC held on January 3, 2021, includes Coinbase with more than $37 billion worth of BTC, Huobi ($10.8B), Binance ($10.2B), Bitfinex ($8.86B), and Kraken ($6.65B) respectively.

87,954 BTC worth over $2.8 billion using today’s BTC exchange rates has left centralized exchanges during the last 30 days, according to viewbase.com stats. 72,727 BTC left exchanges during the last seven days alone and on Sunday, there’s been an inflow of around 5,885 BTC.

3,457 BTC of that daily inflow was sent to the crypto trading platform Binance on Sunday. Alongside this, approximately 1,070 BTC of the 5,885 BTC was sent to the trading exchange Bitfinex on Sunday as well.

The data suggests that a lot more people are removing funds off of centralized exchanges in order to hold bitcoin in a noncustodial fashion. From this perspective, more people holding coins noncustodially is beneficial for the entire community by leaving fewer funds on exchanges that are susceptible to large bitcoin thefts.

Another theory is that bitcoin whales have adopted a new strategy rather than dumping coins on the market and purchasing bitcoin off weak hands that panic sell. Bitcoin whales may be removing liquidity from exchanges and decimating any type of upper barrier.

What do you think about the number of bitcoin fleeing exchanges during the last year and the 87,954 bitcoin withdrawn during the last 30 days? Let us know what you think about this subject in the comments section below.

The post Massive Exodus of Bitcoin Continues to Leave Exchanges, Over 87,900 BTC Withdrawn in 30 Days appeared first on Bitcoin News.

The post Massive Exodus of Bitcoin Continues to Leave Exchanges, Over 87,900 BTC Withdrawn in 30 Days appeared first on Crypto Scoop News.

The post Massive Exodus of Bitcoin Continues to Leave Exchanges, Over 87,900 BTC Withdrawn in 30 Days appeared first on GQ Central.

Comments are closed