.blurb__title{text-transform:capitalize;color:#00a38f;font-size:18px;line-height:21px;font-weight:700;text-align:center;background:#fff;position:absolute;top:-11px;text-align:center;transform:translate(-50%,-50%);left:50%;top:-1%;padding:0 7px}

.blurb__container:before{content:” “;background-image:url(data:image/svg+xml;base64,PD94bWwgdmVyc2lvbj0iMS4wIiBlbmNvZGluZz0iaXNvLTg4NTktMSI/Pg0KPCEtLSBHZW5lcmF0b3I6IEFkb2JlIElsbHVzdHJhdG9yIDE4LjAuMCwgU1ZHIEV4cG9ydCBQbHVnLUluIC4gU1ZHIFZlcnNpb246IDYuMDAgQnVpbGQgMCkgIC0tPg0KPCFET0NUWVBFIHN2ZyBQVUJMSUMgIi0vL1czQy8vRFREIFNWRyAxLjEvL0VOIiAiaHR0cDovL3d3dy53My5vcmcvR3JhcGhpY3MvU1ZHLzEuMS9EVEQvc3ZnMTEuZHRkIj4NCjxzdmcgdmVyc2lvbj0iMS4xIiBpZD0iQ2FwYV8xIiB4bWxucz0iaHR0cDovL3d3dy53My5vcmcvMjAwMC9zdmciIHhtbG5zOnhsaW5rPSJodHRwOi8vd3d3LnczLm9yZy8xOTk5L3hsaW5rIiB4PSIwcHgiIHk9IjBweCINCgkgdmlld0JveD0iMCAwIDE4My43OTIgMTgzLjc5MiIgc3R5bGU9ImVuYWJsZS1iYWNrZ3JvdW5kOm5ldyAwIDAgMTgzLjc5MiAxODMuNzkyOyIgeG1sOnNwYWNlPSJwcmVzZXJ2ZSI+DQo8cGF0aCBmaWxsPSIjMDBBMzhGIiBkPSJNNTQuNzM0LDkuMDUzQzM5LjEyLDE4LjA2NywyNy45NSwzMi42MjQsMjMuMjg0LDUwLjAzOWMtNC42NjcsMTcuNDE1LTIuMjcxLDM1LjYwNiw2Ljc0Myw1MS4yMg0KCWMxMi4wMjMsMjAuODIzLDM0LjQ0MSwzMy43NTksNTguNTA4LDMzLjc1OWM3LjU5OSwwLDE1LjEzOS0xLjMwOCwyMi4yODctMy44MThsMzAuMzY0LDUyLjU5MmwyMS42NS0xMi41bC0zMC4zNTktNTIuNTgzDQoJYzEwLjI1NS04Ljc3NCwxNy42MzgtMjAuNDExLDIxLjIwNy0zMy43M2M0LjY2Ni0xNy40MTUsMi4yNy0zNS42MDUtNi43NDQtNTEuMjJDMTM0LjkxOCwxMi45MzYsMTEyLjQ5OSwwLDg4LjQzMywwDQoJQzc2LjY0NSwwLDY0Ljk5MiwzLjEzLDU0LjczNCw5LjA1M3ogTTEyNS4yOSw0Ni4yNTljNS42NzYsOS44MzEsNy4xODQsMjEuMjg1LDQuMjQ2LDMyLjI1Yy0yLjkzOCwxMC45NjUtOS45NzEsMjAuMTMtMTkuODAyLDI1LjgwNg0KCWMtNi40NjIsMy43MzEtMTMuNzkzLDUuNzAzLTIxLjE5OSw1LjcwM2MtMTUuMTYzLDAtMjkuMjg2LTguMTQ2LTM2Ljg1Ny0yMS4yNTljLTUuNjc2LTkuODMxLTcuMTg0LTIxLjI4NC00LjI0NS0zMi4yNQ0KCWMyLjkzOC0xMC45NjUsOS45NzEtMjAuMTMsMTkuODAyLTI1LjgwN0M3My42OTYsMjYuOTcyLDgxLjAyNywyNSw4OC40MzMsMjVDMTAzLjU5NywyNSwxMTcuNzE5LDMzLjE0NiwxMjUuMjksNDYuMjU5eiIvPg0KPGc+DQo8L2c+DQo8Zz4NCjwvZz4NCjxnPg0KPC9nPg0KPGc+DQo8L2c+DQo8Zz4NCjwvZz4NCjxnPg0KPC9nPg0KPGc+DQo8L2c+DQo8Zz4NCjwvZz4NCjxnPg0KPC9nPg0KPGc+DQo8L2c+DQo8Zz4NCjwvZz4NCjxnPg0KPC9nPg0KPGc+DQo8L2c+DQo8Zz4NCjwvZz4NCjxnPg0KPC9nPg0KPC9zdmc+DQo=);background-size:cover;background-repeat:no-repeat;width:22px;height:22px;position:absolute;top:32px;left:25px;top:50%;transform:translateY(-50%)}

How Do Credit Cards Work?

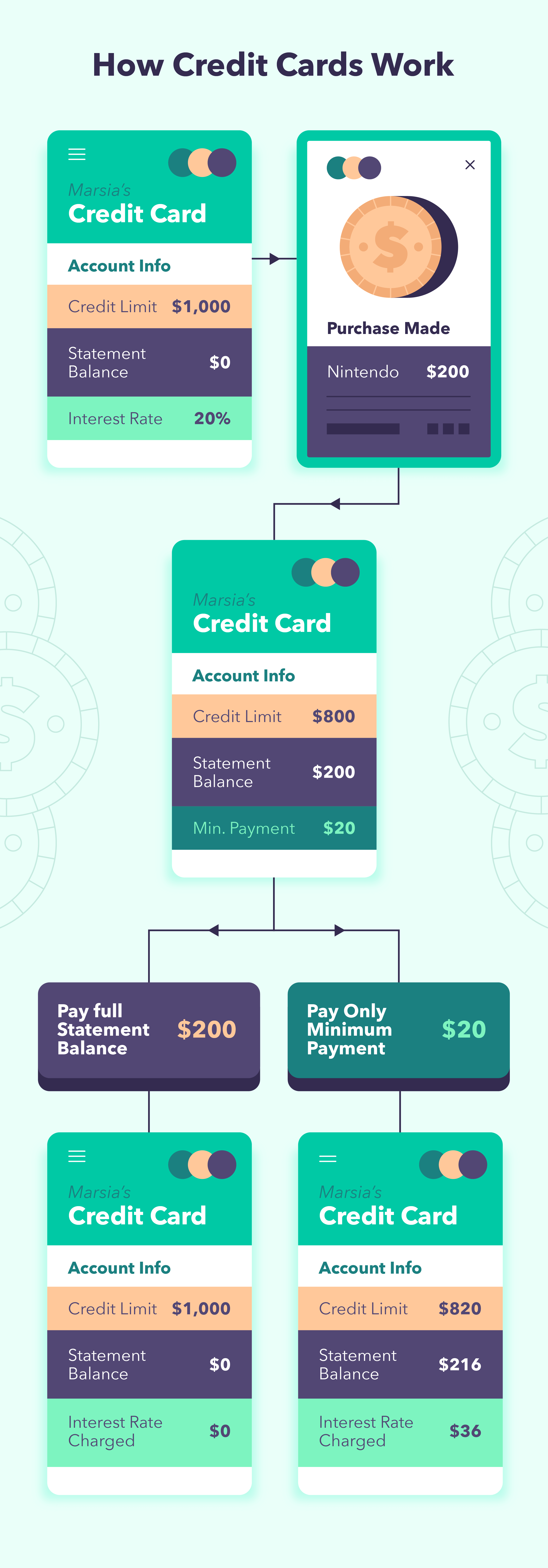

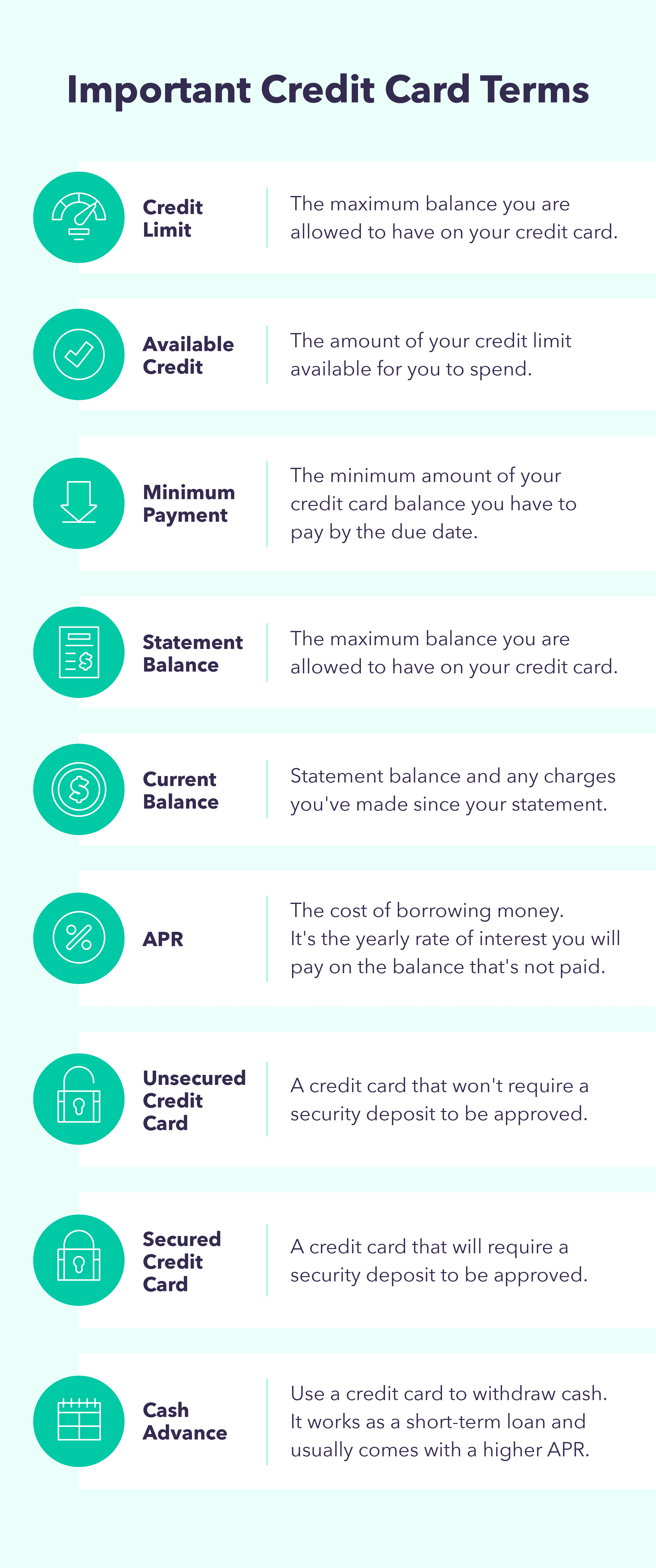

When you use a credit card, you are borrowing money from your bank or credit issuer. When you make a purchase and the payment is accepted, the amount is deducted from your credit limit and added to your current balance.

You are recommended to make the minimum payment for the card or pay the full statement amount once a month. Keep in mind that failing to make payments may result in a penalty, as any outstanding balance is subject to interest fees, which are determined by the annual percentage rate (APR).

APR is the interest rate charged by a creditor when you borrow a line of credit. It is applied to any outstanding balance after the payment due date on the credit card. To prevent interest charges, you must pay off the entire statement balance on each due date. According to U.S. News, the average APR on all credit cards ranges from 15.56 percent to 22.87 percent.

Here’s an explanation of how APR works:

Assume your new credit card has an APR of 18%.

The balance on your credit card is $1,500.

If you keep this balance, you will have to pay interest. After a year, this sum would have increased by $270, or 18% of $1,500. The interest is then added to your balance, bringing it to $1,770.

If you pay the whole debt of $1,500 by the due date, you will not have to pay the $270 in interest.

When you make a payment, your available balance increases by the amount you paid, allowing you to make additional purchases.

Credit Card Suggestion

Set up automated transfers to your credit card to pay off the minimum amount on each statement. However, try to pay your credit card bill in full every month.

What Is the Difference Between a Credit Card and a Debit Card?

Credit cards and debit cards are not the same things, despite their appearance. A debit card deducts funds from your checking account automatically. When you use a credit card to make a purchase, you are not spending your own money at the time.

When you use a credit card to make a purchase, you are spending the credit issuer’s money, which you must pay back later and is subject to interest costs.

| Credit Card | Debit Card |

|---|---|

| Offers a line of credit | Takes off money directly from account |

| Make a least the minimum payment | No minimum payment required |

| Subject to interest fees | No interest charged |

| Subject to late fees and annual fees | Subject to overdraft fees |

| Used to improve credit score | Does not affect credit score |

The advantage of debit cards is that you don’t have to worry about interest fees or minimum payments, and you probably won’t have to worry about late or yearly penalties, which are common with credit cards. However, if there are insufficient funds in your account to support your purchase, you may be charged an overdraft fee.

Credit cards can also help you enhance your credit score, although debit cards have no effect on your credit score.

Credit Card Suggestion

By paying your credit card on time, you can avoid paying a penalty APR. When you wait more than 60 days to pay off your balance, you will be charged a penalty APR, which is normally one of the higher APRs.

The Advantages of Credit Cards

Do you, however, require a credit card? Credit cards, when utilised wisely, can present you with a plethora of advantages. Here are some reasons why you should think about getting a credit card:

Increase Your Credit Score

A good credit score might be advantageous when purchasing a home or applying for a loan. You might potentially boost your credit score — or start building one — by paying off your credit card on time and maintaining a low credit utilisation ratio.

Convenience

Credit cards are a quick and handy way to pay for products and services. You don’t have to worry about looking for spare cash in your luggage with contactless technology like tap to pay and digital wallets. They are also useful since when you use credit, you essentially pay it later.

Budgeting Instruments

Monthly credit card statements can be a helpful budgeting tool. Your credit card statement might assist you to determine how much you spend and your spending habits.

Protection Against Fraud

To keep you safe from credit card fraud, many credit cards include fraud protection and security measures. Although these safeguards vary by issuer, they may include features such as security alerts, fraud liability, and card locking options.

Rewards

Different credit cards will offer you different types of incentives. Find a card that offers the best benefits for your lifestyle. Cashback and travel miles are two types of credit card benefits.

Credit Card Suggestion

To find out when you might be financially free, use a credit card payment calculator.

Credit Card Types and How They Compare

Finding the perfect credit card for you might help you better manage your money and improve your credit score.

If you wish to compare credit cards side by side, consider the following:

What are the yearly fees?

Is there a free credit score checker available?

Is there a required minimum deposit?

What types of prizes are available?

The following are some examples of credit cards:

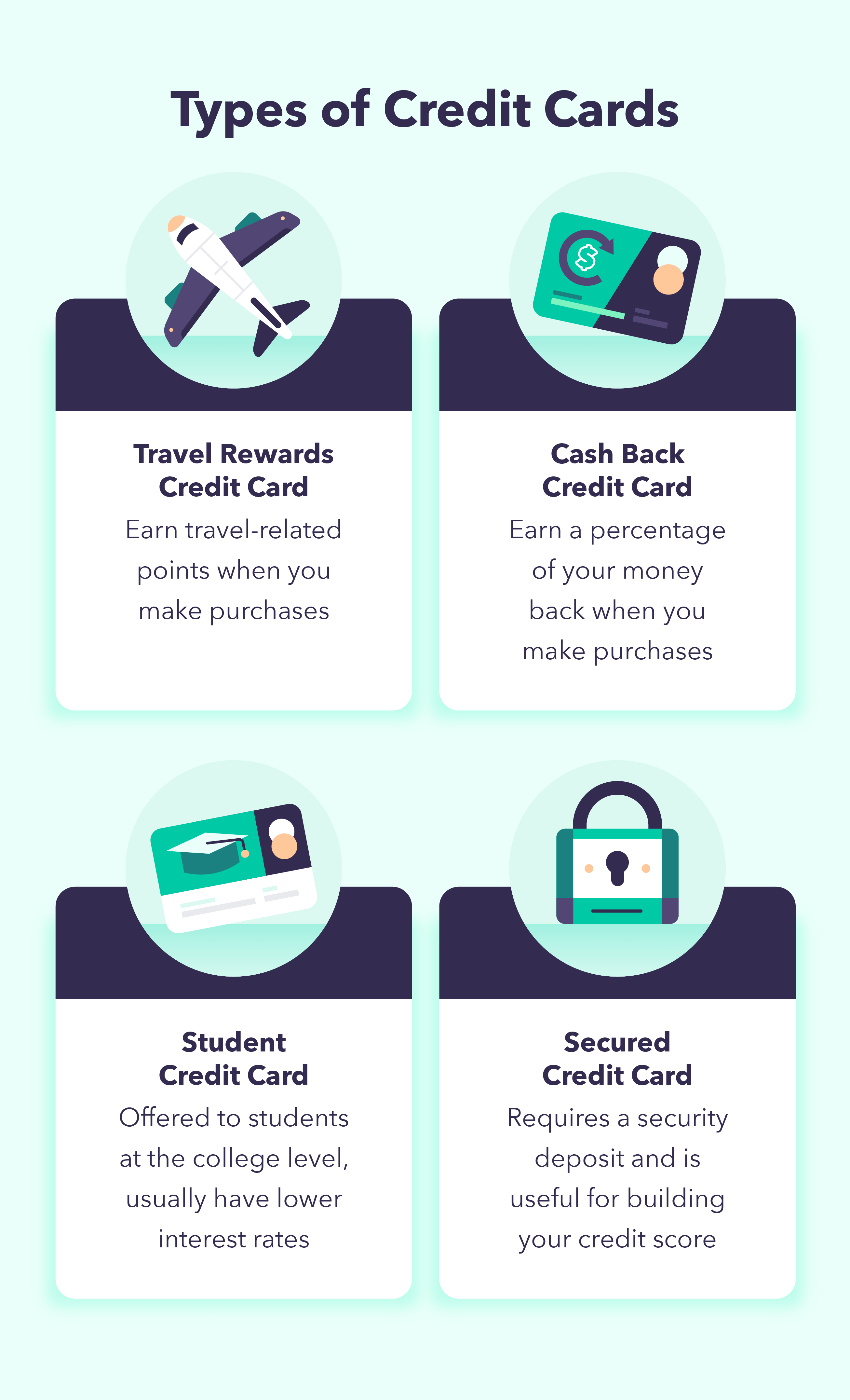

Travel Rewards Credit Cards

Consider a travel rewards credit card if you travel frequently or would like to travel more. You may use this card to earn points for travel-related expenditures such as flights and hotels. Keep in mind that some credit cards are linked to specific airlines or hotels and that you can only redeem your rewards through them.

Credit Cards with Cash Back

Cash return credit cards allow you to earn cashback on daily transactions like groceries, gas, and internet shopping. Some cards will provide a higher percentage of rewards for different categories, so it’s a good idea to choose one that offers the best benefits for what you spend the most money on.

Credit Cards for Students

Student credit cards are typically easier to qualify for because they are aimed at college students. If used wisely, these cards can help students establish credit and give rewards that are meaningful to them.

Credit Cards That Are Secured

Secured credit cards are excellent if you are just starting to develop credit, have a low credit score, or do not yet qualify for certain cards.

When you apply for a secured credit card, you will be required to put down a security deposit as collateral. You will be able to use the card normally and earn the deposit back by making on-time payments.

Secured credit cards differ from unsecured credit cards in that they consider your income and credit history but do not require collateral.

Credit Card Suggestion

Using Mint’s credit card finding tool, you can compare the best credit card offers and apply for a card.

How to Build Credit and Make the Most of Your Credit Card

Once you’ve been approved for the correct credit card for you and understand how credit cards work, you must use your credit card carefully in order to develop a solid credit score. Here’s how to improve your credit:

Make On-Time Credit Card Payments

One of the most crucial aspects of credit building is making on-time credit card payments. That’s because your payment history is the most important aspect in determining your credit score.

Setting up automatic payments or setting reminders is the best approach to pay your credit card on time.

Strive for a Low Balance

Your credit score will suffer if your credit card debt is too high. Try to spend less than 30% of your credit limit each month to keep your credit card amount low. Also, only spend what you can afford to repay.

Maintain the Account

Your credit score is also affected by the age of your accounts. As a result, keep your older credit card accounts open to aid in the development of your credit score.

Request an Increase in Credit Limit

A bigger credit limit can assist you to keep your balances below the recommended 30 per cent if you wish to aim for a low balance. After a year of owning a credit card, you can normally request an increase in your credit limit.

Take Note of Your Credit Score

It’s critical to monitor your credit score in order to understand how you might enhance it. The FICO, or Fair Isaac Co., score is typically the most used by lenders, so make sure to check it every few months.

Credit Card Suggestion

Using the Mint app, you may get a free credit score and track your credit.

In conclusion

If used wisely, having a credit card is a terrific way to start earning a solid credit score. Now that you understand how credit cards work and their perks, it’s time to choose the finest credit card for you and begin budgeting intelligently.

Credit Card Frequently Asked Questions

Understanding how credit cards work is difficult; here are some questions you may have.

Credit Cards: How Do They Make Money?

Credit card companies generate the majority of their money by charging interest on the statement balance. They can also generate revenue by charging bank fees, such as late and yearly fees.

What Exactly Is APR?

The annual percentage rate, or APR, is simply the cost of borrowing money. It is applied to any outstanding balance after the payment due date on the credit card. The average credit card APR ranges from 15.56 per cent to 22.87 per cent.

How Do Credit Card Transactions Work?

When you pay using a credit card, the allowed payment is added to your existing debt and your available credit is lowered by that amount. Once the statement balance is available, you will be able to pay a minimum, the entire statement amount, or a custom amount. If there is any lingering amount in the statement after you have paid off your debt, it will be subject to an interest fee charge.

What Is the Process of Credit Card Interest?

If the remaining statement balance is not paid in whole, credit card interest is imposed. It may be determined using your credit card APR, as well as the average daily rate and balance. A step-by-step calculation is available here.

Post Credit Card 101: What Is a Credit Card and How Do They Work? appeared first on MintLife Blog.

The post Credit Card 101: How Do Credit Cards Work appeared first on https://gqcentral.co.uk

Comments are closed